What is Credit Acceptance Mobile; Pros and Cons; Key Features; Functions; How to Use

What is Credit Acceptance Mobile

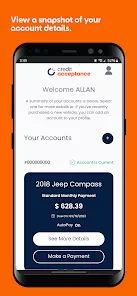

Credit Acceptance Mobile is the official app developed by Credit Acceptance Corporation to help customers manage their auto loans conveniently from their smartphones. Designed for existing borrowers, the app provides an easy way to make payments, review account details, and access statements anytime, anywhere. Through a secure and intuitive interface, users can track their loan balance, view payment history, and update personal information without needing to visit a branch or use a desktop computer. The app also sends reminders and notifications to ensure on-time payments, helping users maintain good credit standing. Credit Acceptance Mobile is compatible with both Android and iOS devices, delivering flexibility and convenience for modern car loan management.

Pros and Cons

- Pros:

- Provides easy mobile access to loan information and payment history.

- Secure platform with encrypted data protection.

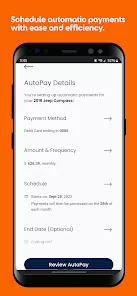

- Convenient payment scheduling and auto-pay options.

- Push notifications help prevent missed payments.

- Reduces the need for phone calls or in-person visits.

- Available 24/7 for real-time account management.

- Free to download with no additional service charges.

- Cons:

- Only available to Credit Acceptance loan customers.

- Requires an internet connection for access.

- Limited financial tools compared to some banking apps.

- Occasional login or loading issues reported by users.

- No support for managing multiple accounts under one login.

Key Features

- Secure login with biometric or password authentication.

- Real-time loan balance and payment status updates.

- In-app payment processing with flexible options.

- Push notifications for payment reminders and account alerts.

- Access to billing statements and account summaries.

- Ability to update personal and contact information easily.

- Detailed transaction and payment history view.

- Compatibility with Android and iOS platforms.

Functions

- Enables users to view account balances and loan details instantly.

- Allows one-time or recurring loan payments via debit card or bank account.

- Provides account alerts to ensure users never miss a due date.

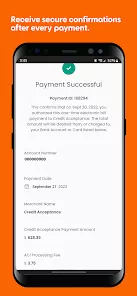

- Facilitates access to digital statements and receipts.

- Improves customer experience through simplified account navigation.

- Acts as a direct communication channel between customers and Credit Acceptance.

- Ensures secure access to sensitive financial information.

- Streamlines loan management for on-the-go users.

How to Use Credit Acceptance Mobile

- Download the Credit Acceptance Mobile app from the Google Play Store or Apple App Store.

- Open the app and log in using your existing Credit Acceptance credentials.

- If you’re a first-time user, register for an account using your loan number and personal details.

- Navigate to the dashboard to view your loan balance and due date.

- Select “Make a Payment” to choose your payment method and amount.

- Set up automatic payments if desired to avoid missed deadlines.

- Access account statements, update contact information, or enable push notifications for reminders.

- Log out securely after completing your session to protect your account.

0

0